How the industry is performing and where it's headed.

For the cannabis industry, the only constant is change. Marijuana regulations, laws, sentiment, technology and business practices evolve each year—meaning there’s a long list of new data and insights to unpack.

To paint a clear picture of the cannabis industry, we scoured the internet to find the most important and relevant marijuana statistics for 2024.

In this report, you’ll see marijuana use statistics, the national sentiment around weed acceptance/accessibility, marijuana market growth, employment trends, and legal facts.

Let’s dive into the findings.

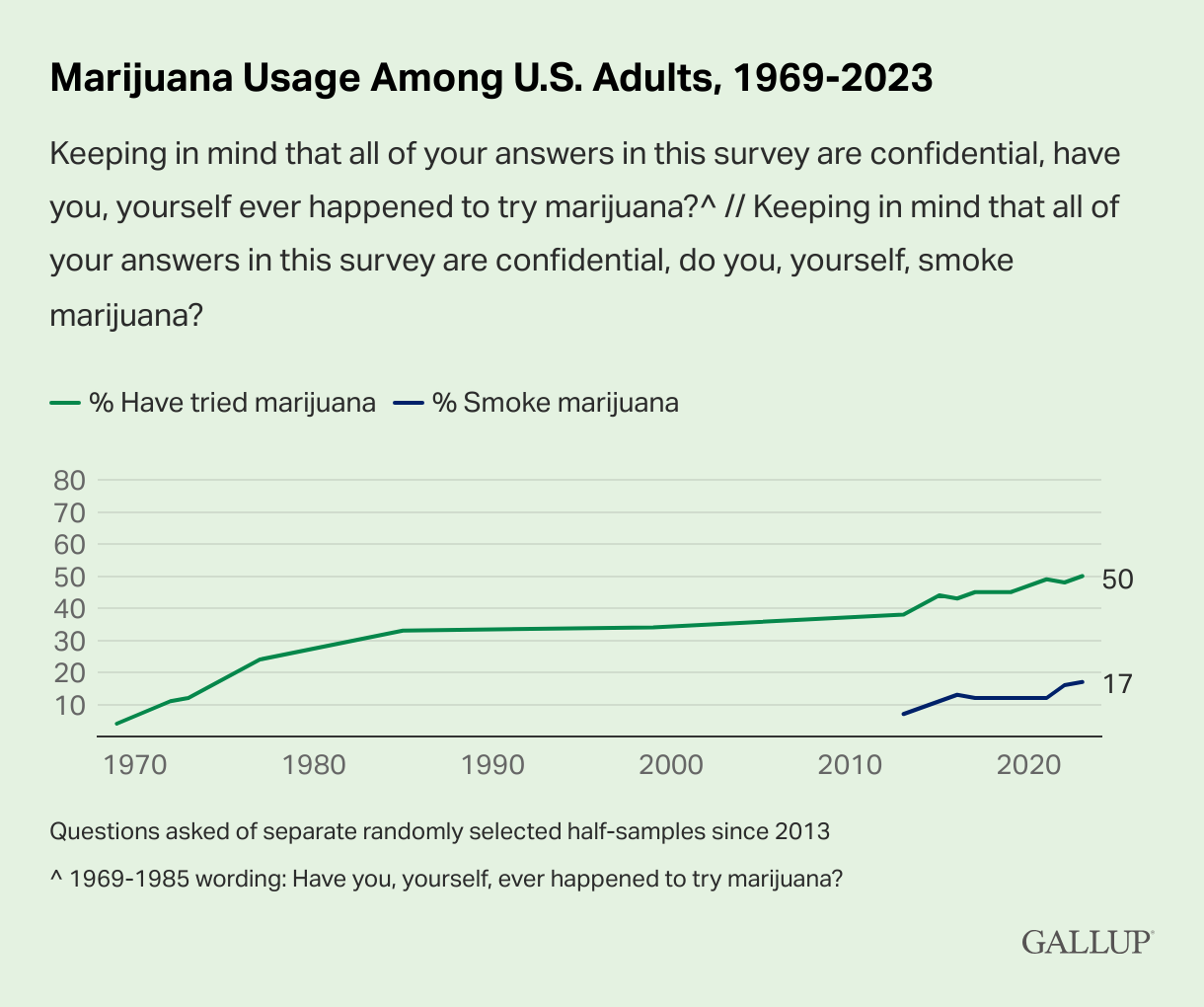

According to Gallup, fully half (50%) of Americans say they have tried marijuana at some time, which is a new high point.

In an answer to a separate question, roughly one in six Americans (17%) say they "smoke marijuana." This is also a new high for Gallup.

A recent study conducted by The Harris Poll on behalf of MedMen found more than one-third (37%) of American women aged 21+ consume cannabis.

The national survey also uncovered women primarily use cannabis for therapeutic reasons. The top three reasons women use cannabis is to relieve anxiety (60%), help them sleep (58%), and relieve pain (53%).

Many of these female cannabis consumers are doing so privately. The study found 65% of women who use cannabis say there are people in their lives who still do not know they are doing so, including their parents, children, and coworkers.

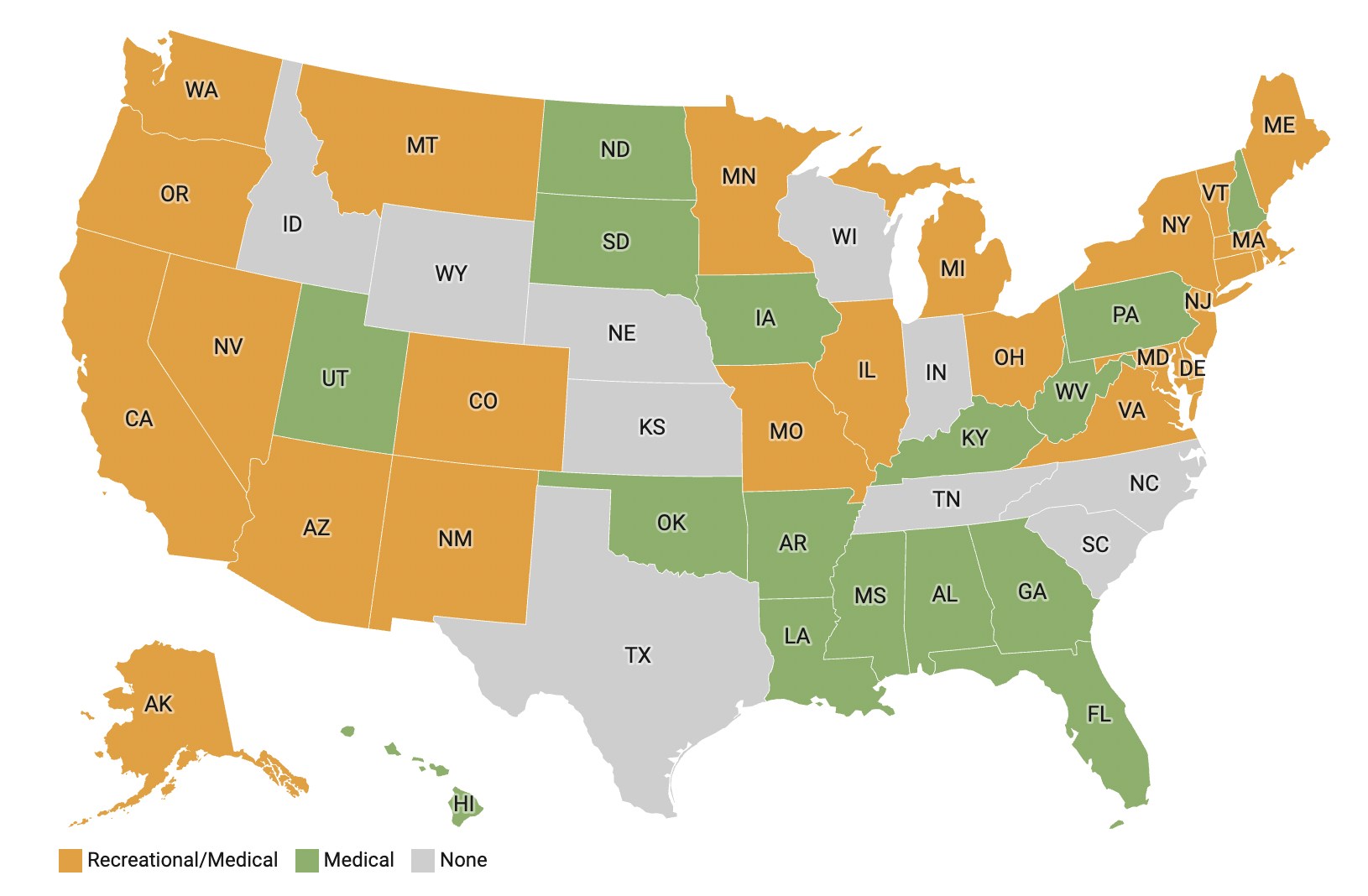

Most Americans now live in a state that has legalized cannabis. Pew Research broke down the details to find:

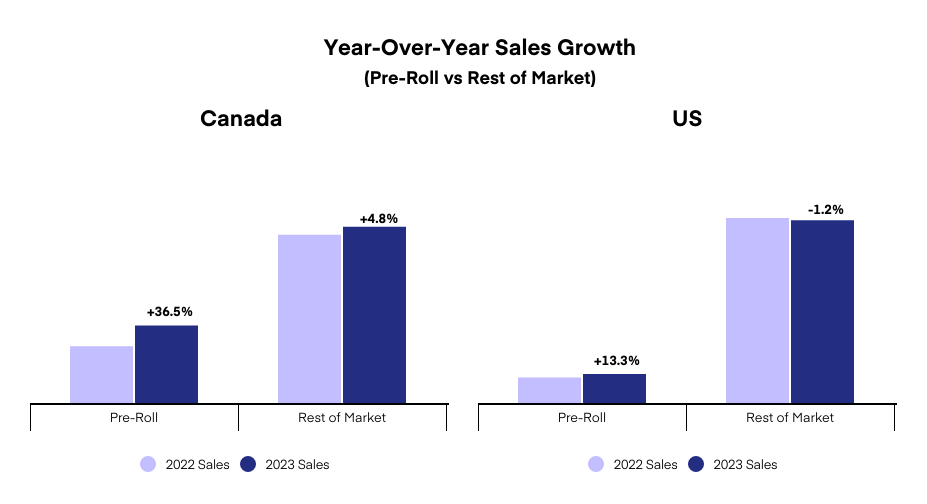

Pre-rolls are the third largest product category in the US after Flower and Vapor Pens. They’ve exploded in popularity since the start of 2022.

Headset found when comparing the first eight months of 2023 to the previous year, US pre-roll sales increased by 13.4%, outperforming other categories like edibles or concentrates by a large amount.

Pre-rolls are also capturing a significantly larger share of total dispensary sales. In the US, pre-rolls captured 15.3% of total sales, up 32% from 11.6% in January 2022.

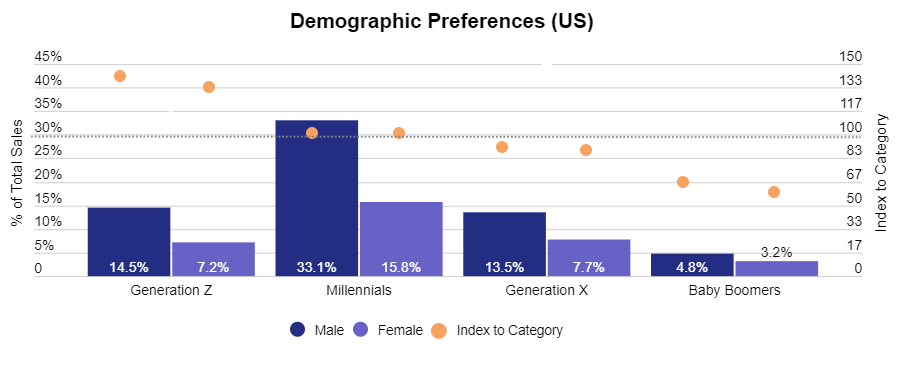

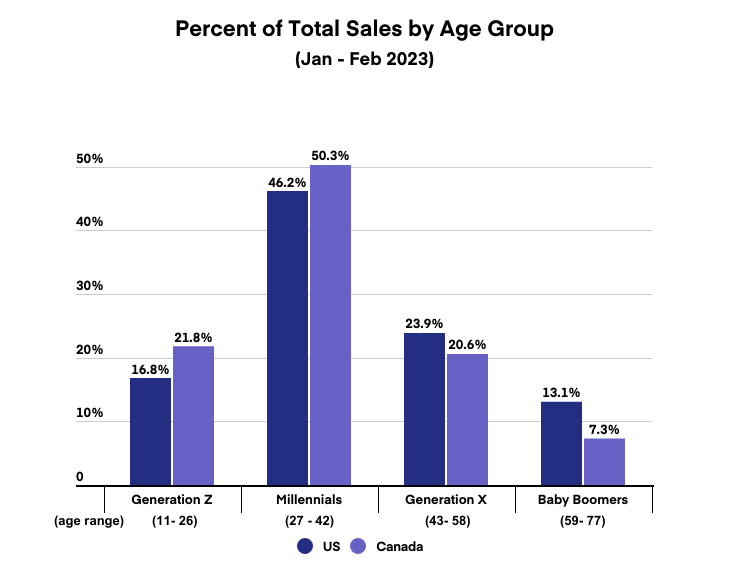

Together, Gen Z and Millennials make up 62.8% of all US cannabis sales and 70.8% of all Vapor Pen sales based on data from Headset.

Gen Z is already known to be attracted to nicotine vaporizers, which influences the way they consume cannabis. This is likely due to their familiarity with the consumption method since we see diminishing Vapor Pen preference with increasing age.

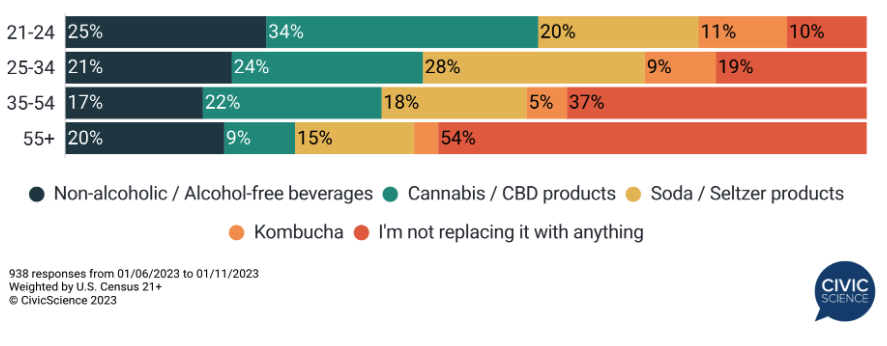

A recent survey from CivicScience found that 21% of people doing Dry January — a popular trend where you abstain from alcohol for the month — are replacing alcohol with cannabis and CBD.

The same survey uncovered that the largest demographic of people replacing alcohol with cannabis are aged 21-24 (34%), followed by 25-34-year-olds (24%).

We’ve seen this trend of younger individuals replacing alcohol with cannabis rising since the pandemic. These Dry January statistics confirm the assumption that more people from younger generations are turning away from alcohol and using cannabis as an alternative.

As of January 2024, 24 states, the District of Columbia, and Guam have legalized recreational cannabis use for individuals age 21+: Alaska, Arizona, California, Colorado, Connecticut, Delaware, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Ohio, Oregon, Rhode Island, Vermont, Virginia, and Washington.

Delaware, Minnesota, and Ohio were added to the list of legal adult-use cannabis states in 2023.

Medical use of marijuana is now legal in 40 states plus Washington D.C. for medical purposes: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Hawaii, Illinois, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Utah, Vermont, Virginia, Washington, and West Virginia.

Kentucky was added to the list of legal medical cannabis states in 2023.

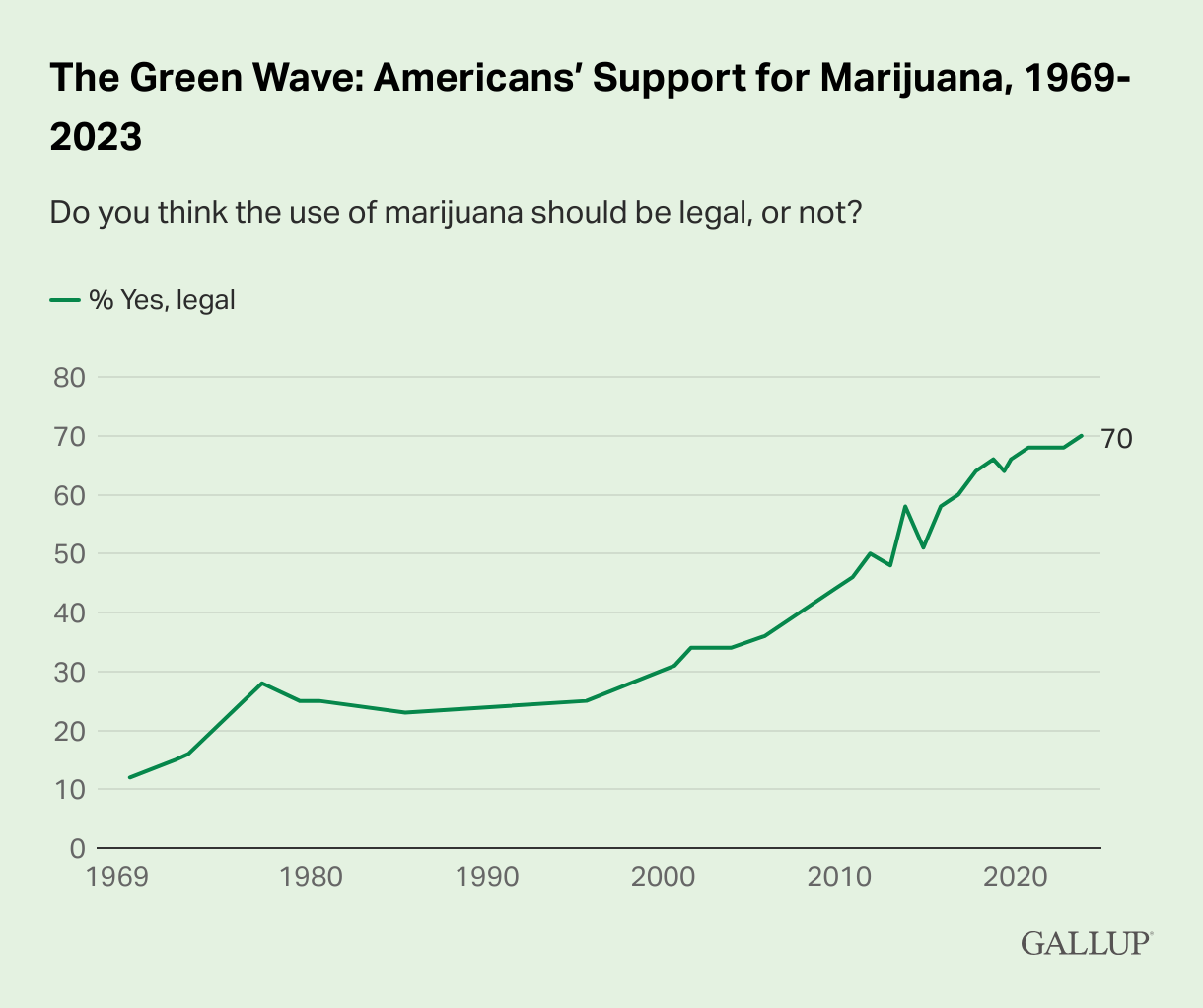

According to a recent Gallup poll, seven in 10 Americans think cannabis should be legal, the highest level ever recorded.

The first time Gallup gathered this data in 1969, just 12% of Americans were in favor of legal cannabis.

A recent study published in Clinical Therapeutics found 91% of military veterans who visit providers for medical cannabis said it has improved their quality of life.

Medicinal cannabis use was reported to improve quality of life and reduce unwanted medication use by many of the study participants. The present findings indicate that medicinal cannabis can potentially play a harm-reduction role, helping veterans to use fewer pharmaceutical medications and other substances.

Clinical Therapeutics, June 2023

As marijuana use is more broadly accepted, its prevalence for positive health effects and benefits toward public health are increasing. For veterans struggling with PTSD, substance use, illicit drug use, and more, the cannabis plant has entered as a supplement for traditional health care and prescription drugs.

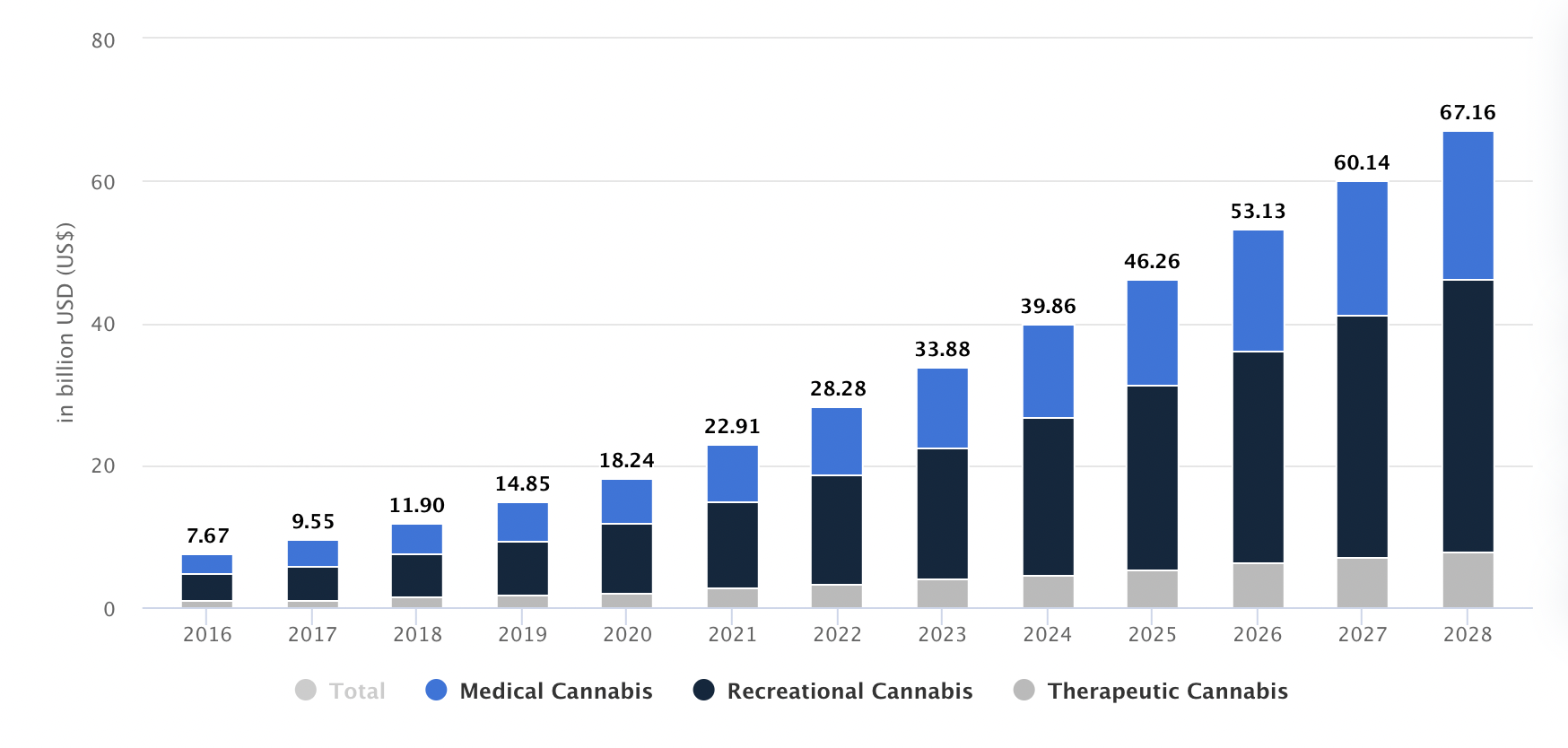

According to projections from Statista, total revenue from cannabis is expected to reach $39.85 billion in 2024.

Statista also projects the cannabis market to reach over $67 billion in revenue by 2028 as the legalization movement surrounding cannabis evolves.

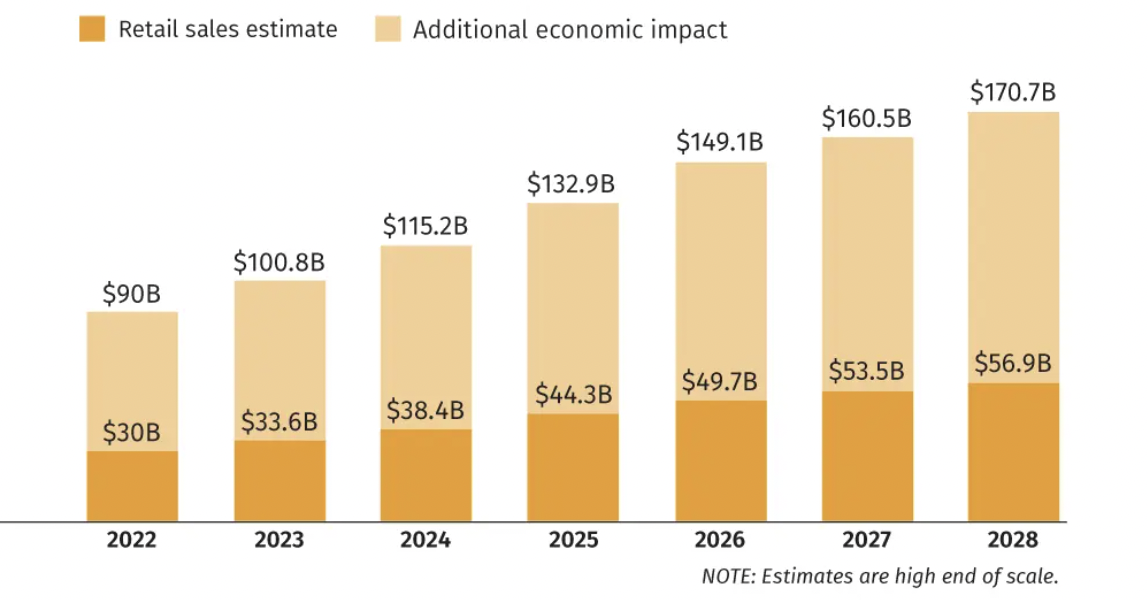

According to the MJBizFactbook, for every $10 consumers and patients spend at dispensaries, an additional $18 will be injected into the economy.

Much of this economic stimulation happens at the local level, contributing to growth in the same neighborhoods where the cannabis products are being sold.

Cannabis is often compared to the alcohol industry, even though the two are innately different.

It appears cannabis isn’t just better for avoiding hangovers, it’s also earning states more money in tax revenue.

The Tax Foundation uncovered the following surrounding cannabis vs. alcohol tax:

“The largest and longest-established markets generated the most [cannabis tax] revenue in California, Washington, and Colorado. In the first quarter of 2023, 10 states—Arizona, Colorado, Maine, Massachusetts, Michigan, Montana, Nevada, New Mexico, Oregon, and Washington—generated more revenue from cannabis than from either alcohol (9 states) or tobacco (Washington).”

In 9 states, cannabis brings in more tax revenue than alcohol—and that number is only expected to rise.

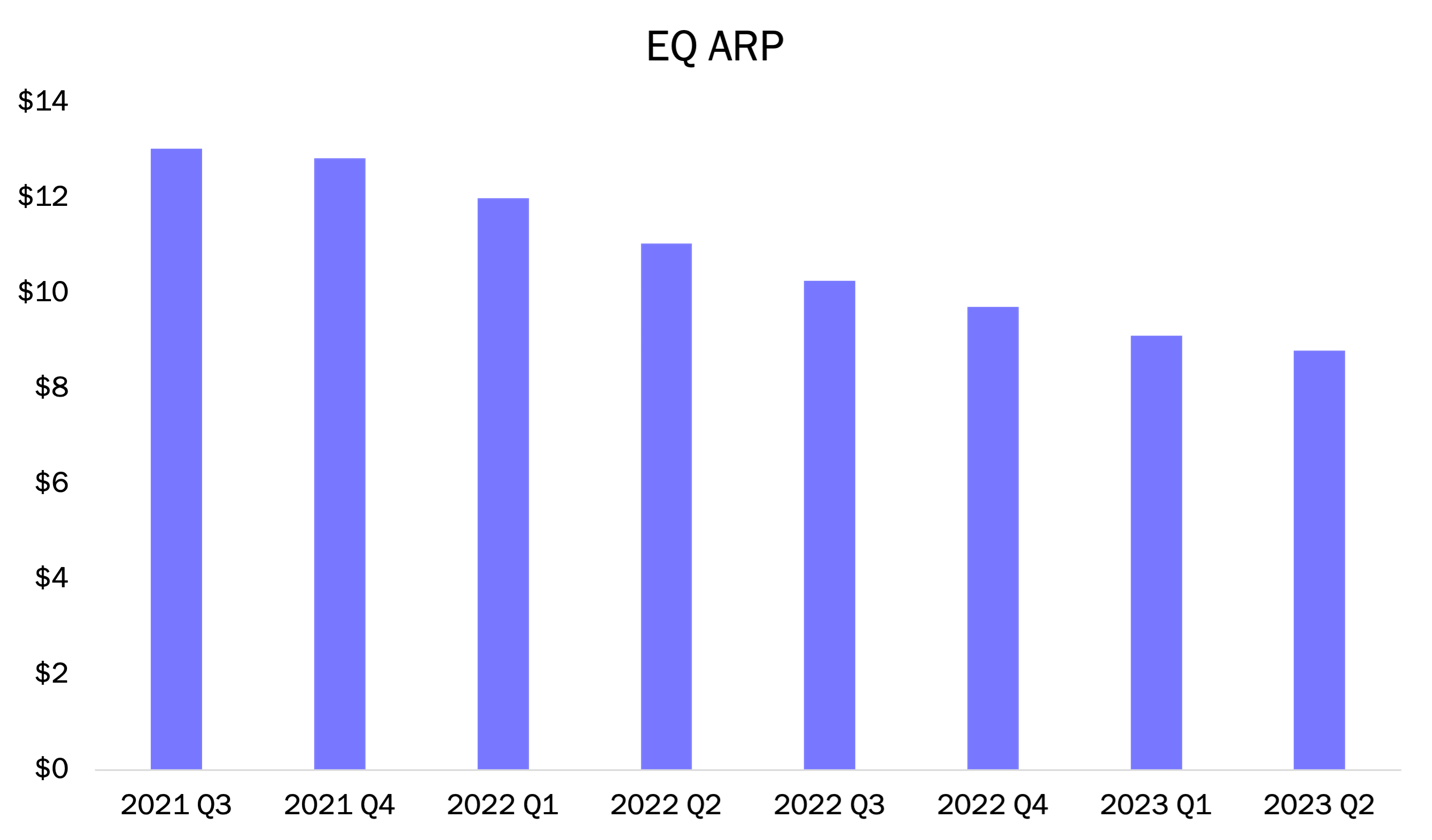

Competitive pricing trends among cannabis brands and retailers has led to significant price declines beginning in 2021. While there are signs this compression is slowing and even rising in some states, it’s important to track this compression.

BDSA Retail Sales Tracking found equivalent average retail prices (EQ ARP) dropped -32% (from their peak in Q3 2021 to Q2 2023). This price decline, along with inflation (which has increased costs for labor and materials for licensees), has made the industry even more competitive.

Compressing prices impact cannabis brands and retailers, squeezing profit margins and forcing dispensaries to fight to combat the effects of marijuana price compression.

For THC brands, price compression has led to considerable consolidation. Across all BDSA-tracked markets, the share of total sales held by the five best-selling brand houses grew by +14% between Q2 2021 and Q2 2023.

Similarly, around 25% of the 50 best-selling flower strains in both California and Colorado come from a single brand. This shows just how competitive (and compressed) the brand landscape is becoming.

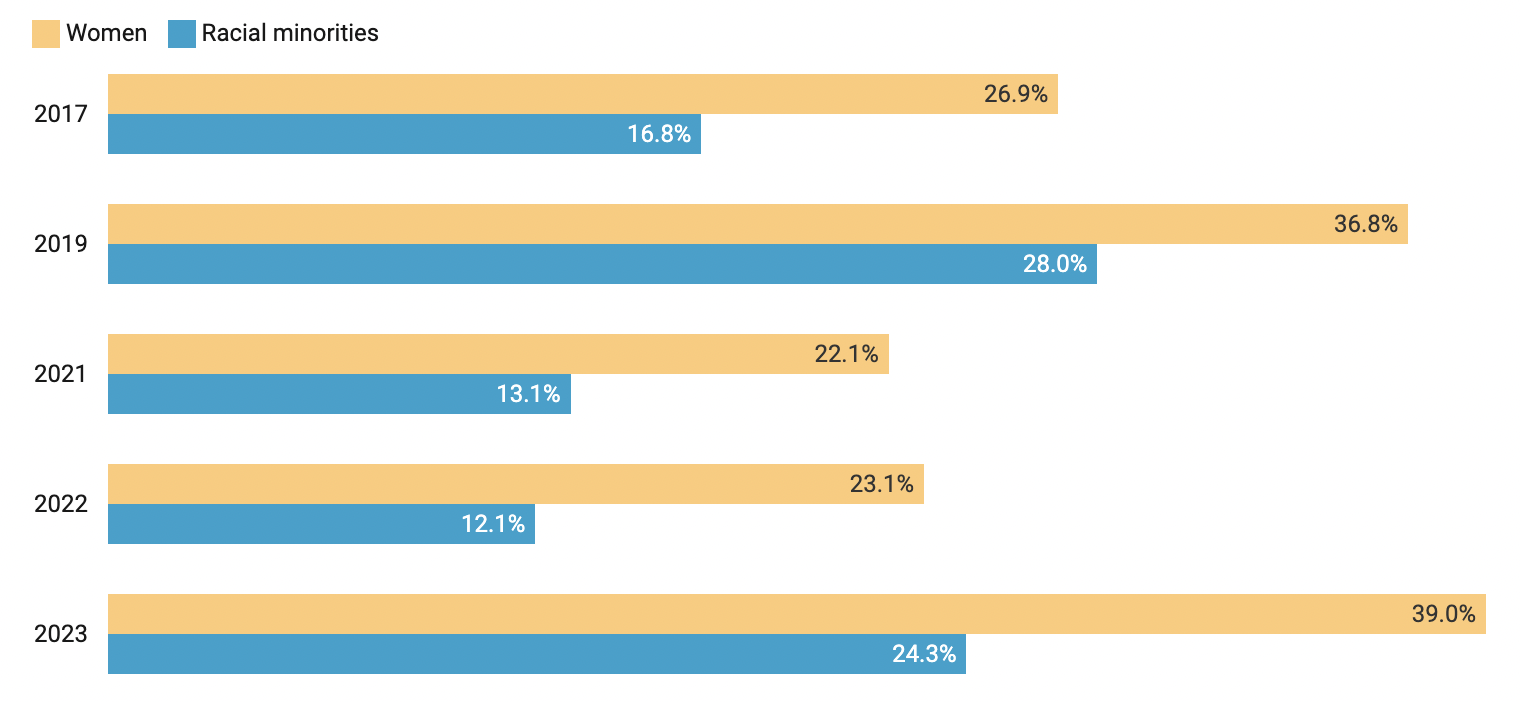

The latest data from the MJBiz Diversity, Inclusion and Equity Report found women account for 39% of cannabis executives while racial minorities reached 24%. This is a significant jump from the past year’s 23% women and 12% racial minorities.

The cause of this jump is still unclear. Andrew Long of MjBizDaily explains, “Diversity returned to the C-suite for reasons that have yet to be determined.”

While they’ve been criticized in the past for falling short, cannabis social equity programs appear to be supporting marginalized groups in the industry.

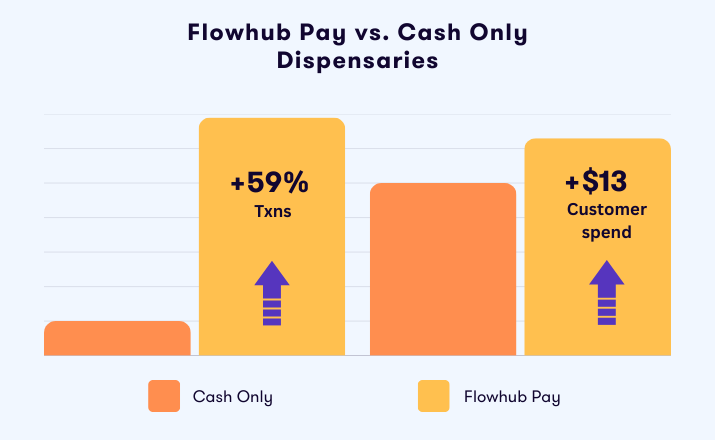

Flowhub data from Green Wednesday 2023 found dispensaries accepting debit cards earned an average of $4,627 more per day than cash only retailers.

Additionally, dispensaries offering debit payments processed 59% more transactions compared to cash only dispensaries and transactions paid with a debit card were $13 higher than cash only transactions.

Despite its history of being a cash-based industry, cannabis consumers still want to pay with cards.

We're seeing this trend accelerate in all other industries too. The 2023 McKinsey Global Payments Report found cash usage declined by nearly four percentage points globally in 2022.

Expect to see continued adoption and growth of cannabis debit payments throughout 2024.

Headset’s Demographics Report notes the millennial age group is the largest demographic of cannabis consumers, capturing 46.2% of every dollar spent on weed.

However, Gen Z is the fastest-growing group of marijuana users, which is quickly eating away at the dominant market share of Millennials. Year-over-year, these young adults’ percentage share of total cannabis sales has grown by 11.3%.

The contractions of the cannabis industry created a realignment in the sector following the industry’s early explosive success.

Laura A. Bianchi, founding partner of Bianchi & Brandt, explains the situation in a recent Trend Report stating, “We’ve been entrenched in the hyperactive cannabis M&A environment for many years, and after the massive, unexpected pandemic bump—and the ensuing crash of cannabis markets coast to coast—we’re now in The Great Correction. ”

Instead of blockbuster acquisitions and rapid multi-state expansion, we’re seeing small and midsize businesses (SMBs) are now the focus of most M&A activity.

Laura continues in the trend report, explaining “Savvy businesses are looking for mutually beneficial partnerships that allow them to maintain a foothold in the market to ride out this correction. Many of these smaller cannabis businesses are merging for basic survival. Some are finding that their new partnerships are helping them thrive in these conditions. Others are entering into bad partnerships out of desperation, and we will likely see them in court in the future.”

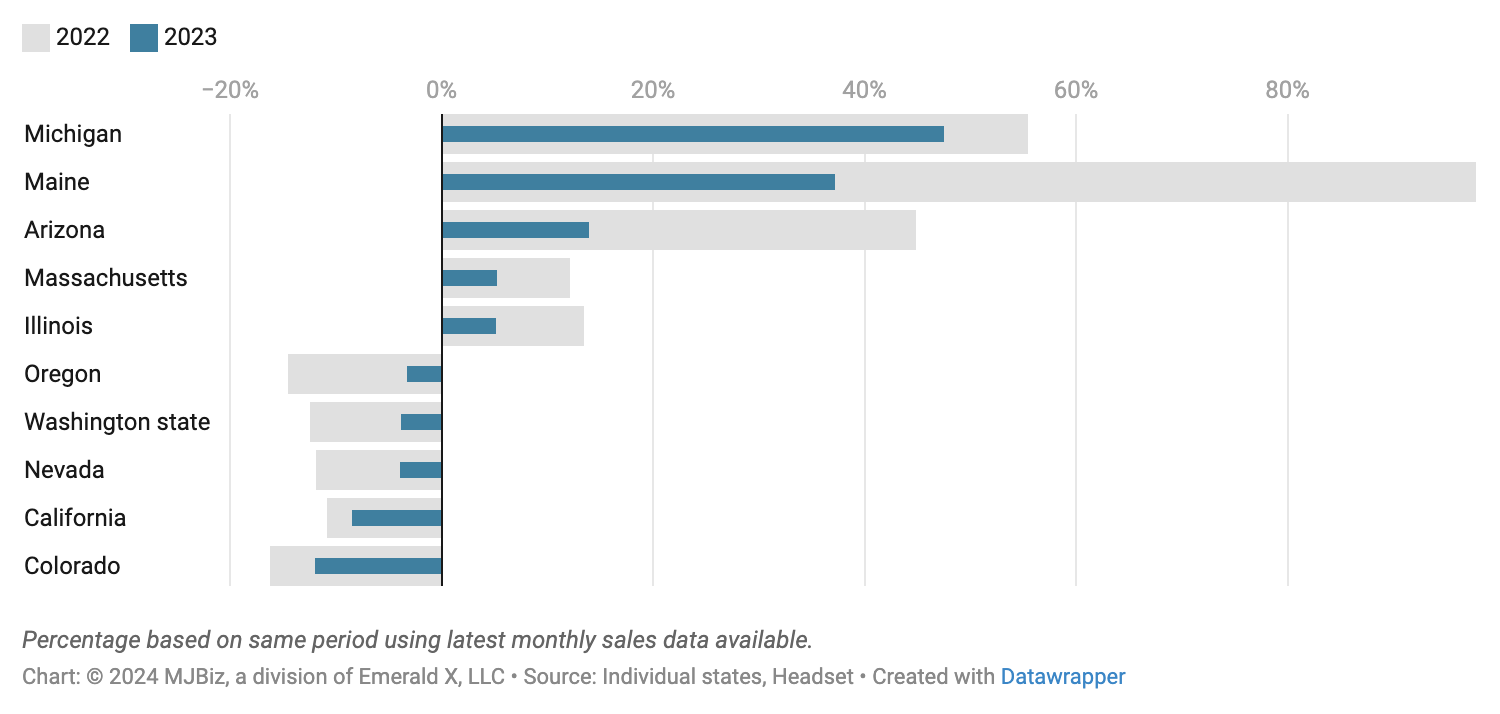

MJBizDaily recently found year-over-year cannabis market growth rates vary by the age of each market.

In new markets like Arizona, Illinois, and Maine, sales continued to grow—but at slower rates than in 2022. For these states, it’s likely the economy that slowed their growth.

At the same time, established markets like Colorado and Nevada did not decline as much as in 2022. For these states, this is a promising sign for 2024.

A recent data dive from BDSA explores the actions dispensary shoppers take before they buy. The report found frequent cannabis shoppers are more likely to prepare for a purchase by researching online.

42% of frequent dispensary shoppers report going online to see the menu at a specific dispensary. This “regular shopper” cohort was also more likely to look for deals and promotions (30% of weekly shoppers compared to 17% of less than monthly shoppers).

The BDSA report also shows planning for purchases differs based on how much consumers spend. Shoppers in the top 25th percentile of per-visit-spending do more online research before replenishing (42% report checking dispensary menus).

In 2024, easily accessible dispensary websites will become increasingly important. Retailers can lean on these cohorts of "researcher-first buyers" by optimizing product pages to rank higher on Google.

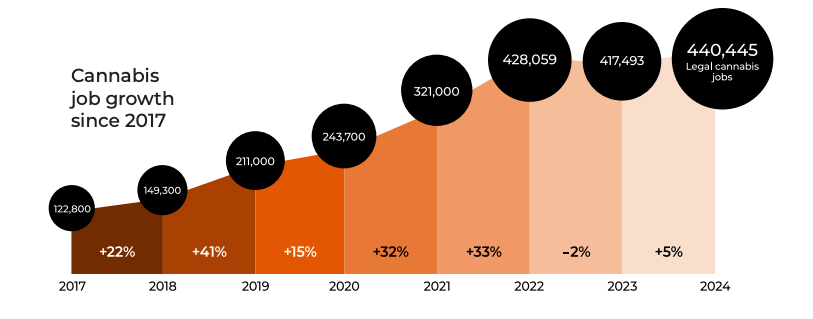

The 2024 Vangst Jobs Report found There are 440,445 full-time equivalent jobs supported by legal cannabis as of early 2024. That number represents a 5.4% year-over-year increase, adding 22,952 new jobs over the past twelve months.

This growth was driven largely by steep-curve expansion in young Midwestern markets — Michigan, Missouri, and Illinois — and the moderate growth of East Coast markets like New York, New Jersey, and Connecticut.

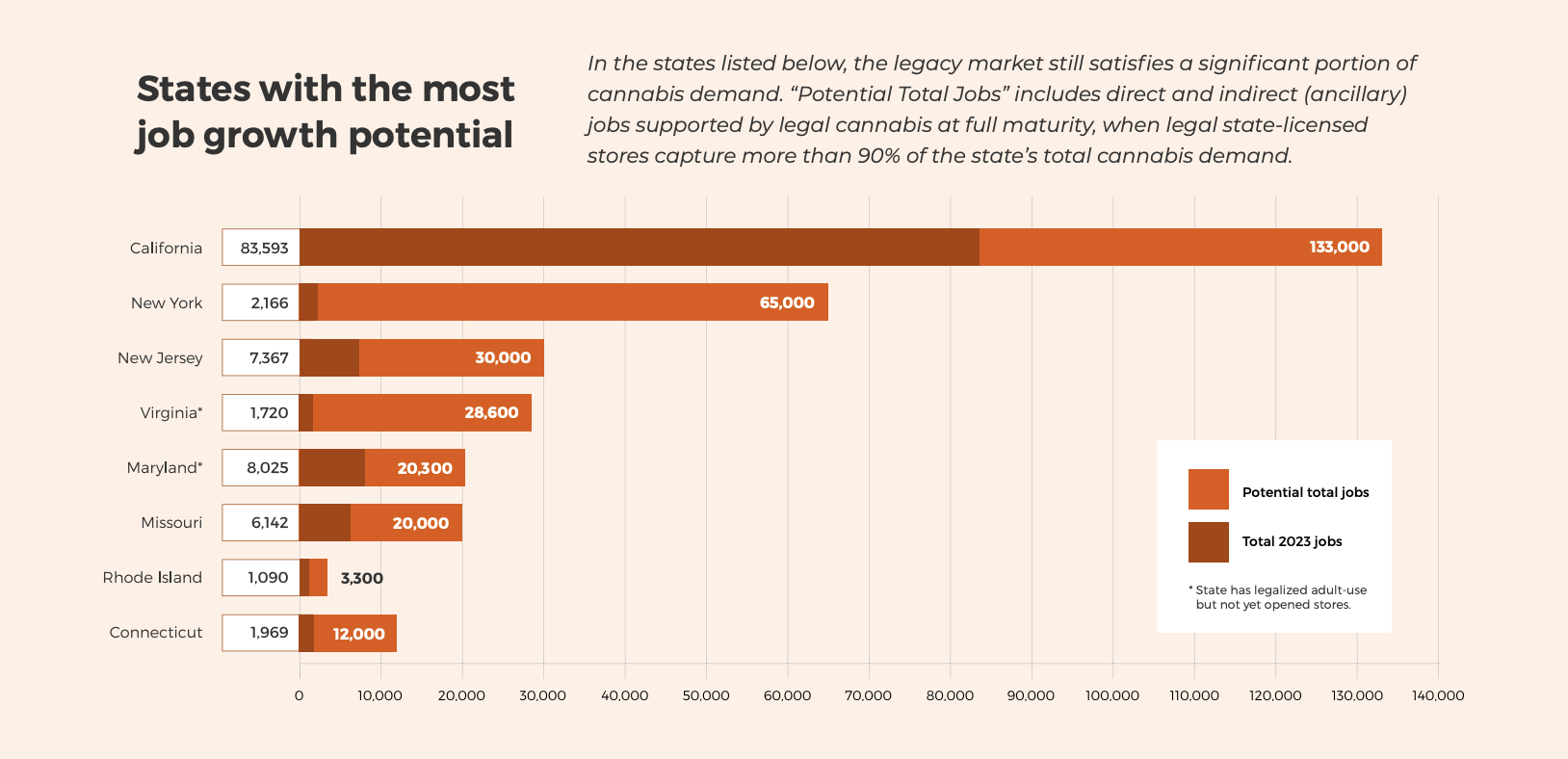

Markets like California, New York, New Jersey, Virginia, and more are yet to tap into the full potential of their respective cannabis industries. For example, California has only reached around 83,000 cannabis jobs of a potential 133,000.

In their Jobs Report, Vangst explains, "If state policymakers work together to move legacy market consumers into legal, licensed, tax-paying stores, we should see the return of double-digit job growth."

In 2024, expect the industry to get back on track in terms of revenue and job growth.

After adult-use cannabis was legalized in 3 states in 2023, five more are planning to take cannabis legislation to the polls this year.

Florida, Hawaii, New Hampshire, Pennsylvania and South Dakota have a realistic chance to legalize adult-use marijuana this year, according to Marijuana Moment.

The dwindling list of states with absolutely no legal cannabis may grow shorter in 2024. Nebraska, North Carolina, South Carolina, and Wisconsin are all moving toward cannabis reform.

We hope to see even more states join this list of legal markets as more consumers and patients will gain access to safe, legal cannabis.

In this election year, there are significant implications surrounding cannabis. The decisions made in 2024 may represent the biggest reform in federal cannabis policy in the past 40 years.

Here’s a timeline of notable moments that may impact cannabis this year:

For now, we can only wait and see what the DEA decides. But one thing is for certain, cannabis policy reform is gaining serious momentum in 2024.

Source: flowhub.com